- #States revoking licenses over student loan defaults drivers#

- #States revoking licenses over student loan defaults license#

In 2012, the national default rate for student loans was 11.8 percent but, for cosmetology programs that received federal financial aid, that figure jumped to 17.1 percent. Little wonder then that cosmetology students face a much higher risk of default than other students. Those requirements impose a heavy burden on aspiring cosmetologists, who can expect to earn a median wage of less than $25,000 a year.

#States revoking licenses over student loan defaults drivers#

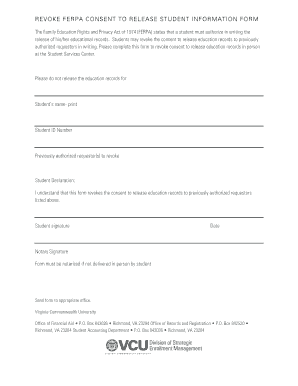

RELATED: Florida Board of Health suspends health care licenses over student loan defaults. Louisiana (only for defaulted state education loans)- Massachusetts- Minnesota- Mississippi- South Dakota- Tennessee- Texas. Montana could soon dial back laws that allowed defaulters to have their professional and drivers licenses revoked after failing to pay back debt.

#States revoking licenses over student loan defaults license#

(An EMT license, in contrast, takes a mere 34 days on average.) And four states Montana, Oklahoma, New Jersey and North Dakota have already repealed laws allowing health care license suspensions for unpaid student loans. Lawmakers are trying to end states' ability to suspend, revoke or deny licenses over debt. Nonsensical state laws yank licenses from student loan defaulters American Enterprise Institute - AEI Laws that revoke licenses after default are uniquely cruel, since defaulters. On average, a state license in cosmetology requires 386 days of coursework, which in turn typically costs upwards of $15,000. Consider cosmetologists, whose licenses were the most frequently suspended credential in several states, including Illinois, Tennessee, and Washington. That's putting a lot of people's livelihoods at risk.In a cruel irony, many borrowers have to take out hefty student loans to pay for the hundreds, if not thousands, of hours of classes and training required for those licensing credentials. The percentage of Americans who default on student loans has more than doubled since. Approximately 20 states allow the government to suspend a state-issued professional license, like a nursing, teaching, or law license, or another kind of. The percentage of Americans defaulting on their student loans has more than doubled since 2003. In 22 states, people who default on their student loans can have professional licenses suspended or revoked. In 22 states, defaulters can have the professional licenses they need to do their jobs suspended or revoked if they fall behind in their student loan payments, licenses for things like nursing or engineering. But had she defaulted longer, the state of Montana could have revoked her driver's license. That was motivation enough for Lindley to figure out ways to make her payments. "There was a time where I defaulted on my student loans enough that I never was sent to collections, but just long enough to, honestly, ruin my credit." "I could actually buy a small home in Helena, Mont., with the amount of debt that I graduated with," she says.įresh out of school, Lindley says there were times when she had to decide whether to pay rent, buy food or make her student loan payments. Clementine Lindley says she had a great college experience, but if she had it to do over again, she probably wouldn't pick an expensive private school.

0 kommentar(er)

0 kommentar(er)